If you’re interested in getting into the world of Non-fungible tokens (NFTs) you’re probably wondering how the value of NFTs work. This guide explains what determines an NFTs value and how NFTs increase in value over time.

So do NFTs go up in value? Yes. NFTs are rapidly increasing in value. Some NFTs are selling for millions of dollars. However, The value of an NFT can increase or decrease based on the market and so can the cryptocurrency it’s minted on.

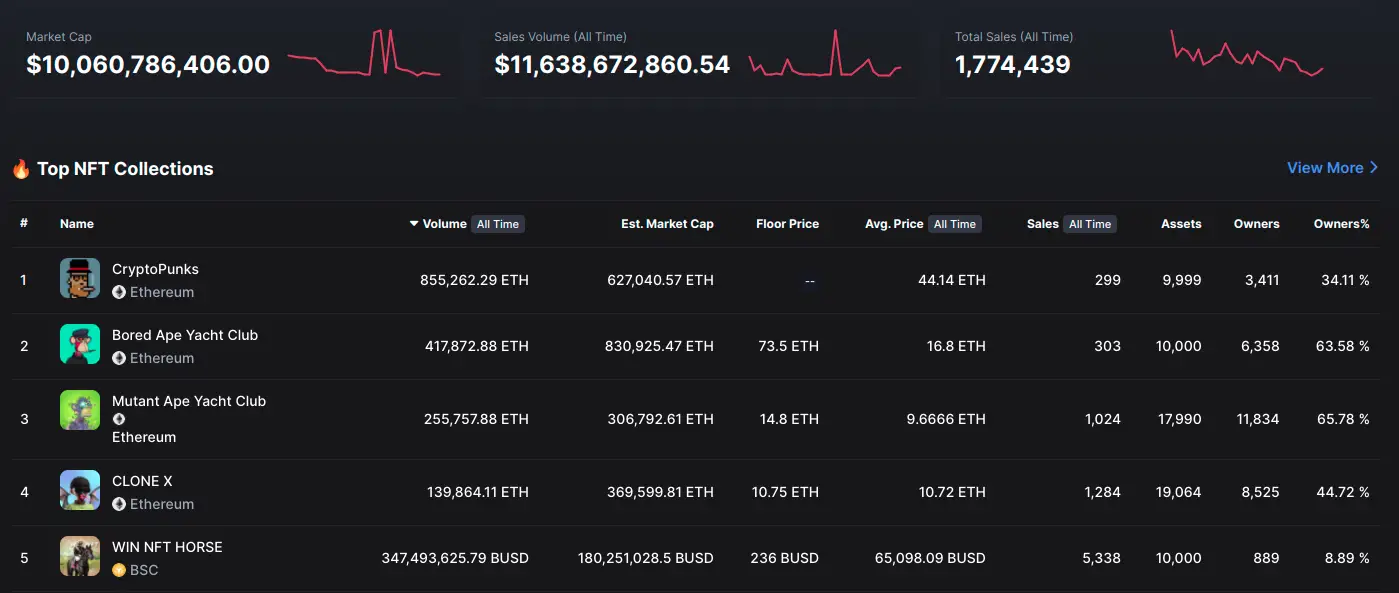

With over 11.5 billion in total NFT sales so far, it’s safe to say the NFT market is still rapidly growing. Let’s dive into the mechanics of NFT market value and how NFTs go up in value.

NFT value explained

All Non-fungible-tokens are minted on a cryptocurrency blockchain, meaning they are bought and sold using the cryptocurrency they are minted on.

Cryptocurrency Value

The initial factor of an NFT’s value is the value of the cryptocurrency it’s minted on. Most NFTs are minted on Ethereum, Polygon, and Solana and most NFT marketplaces support those currencies.

NFT Mint price

When NFTs are first created on a blockchain they have to be minted. Minting is basically the process of publishing the NFT on a blockchain so it can be sold. When NFT collections are first released they are minted by the creator or initial buyers of that NFT. The price of minting is basically the gas fee used to transact with the blockchain. NFT creators that allow buyers to mint an NFT will typically also charge a mint fee, where the buyer covers the cost of minting as well as gas.

NFT Reseller price

Once an NFT has been minted it is typically resold on a marketplace at a price determined by the seller. Sellers can set whatever price they want for their NFTs. The lowest price of NFTs available in a collection is called the floor price. Most NFT marketplaces clearly list the floor price so you know what the minimum investment will be to get in on that collection.

NFTs can be bought and sold between different buyers and sellers, and when this happens the price can go up or down based on whether the NFT is perceived to be increasing or decreasing in value. Sometimes a seller will sell at floor price just to ensure a quick exit from their NFT.

How do NFTs increase in value?

Essentially, NFTs gain value when buyers are able to successfully sell their NFTs at a higher price than what they paid for them. Similar to cryptocurrency, a collection of non-fungible tokens go up in value when the market demand increases and the overall supply of NFTs available for sale decreases.

The key factor here is that someone has to be willing to buy the NFT at a higher price. So basically, an NFT is worth whatever someone is willing to pay for it.

Buyers determine the value of an NFT by looking at the market of a collection. For example, the floor price of a bored ape NFT is currently about 73.5 Ethereum on OpenSea. A year ago when they were first minted they weren’t even selling for 1 Ethereum. That’s a pretty obvious example, but you get the idea.

Most NFT marketplaces have tools and statistics to help determine the market activity and value for specific NFT collections.

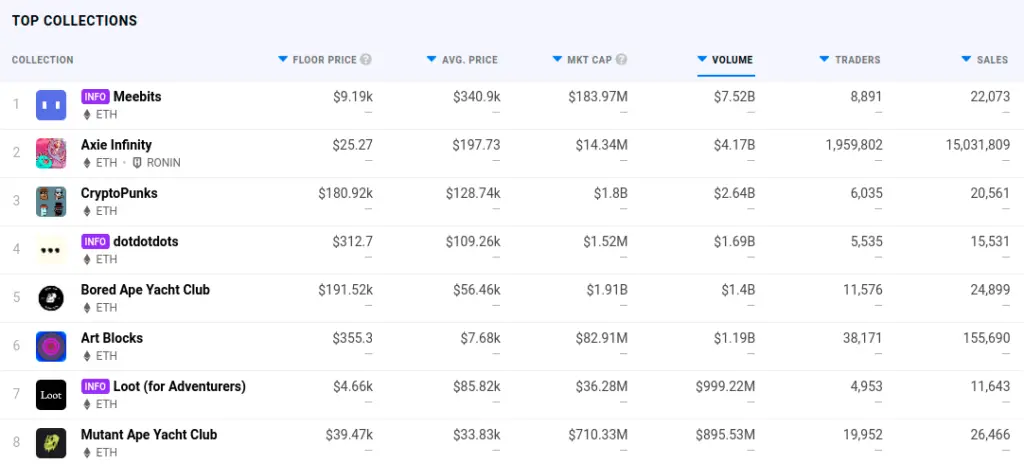

There are also tools like DappRadar which will show you aggregated stats from different marketplaces.

In the example above, you can see the total trading volume for the top NFT collections across several marketplaces on DappRadar.

NFT market volatility

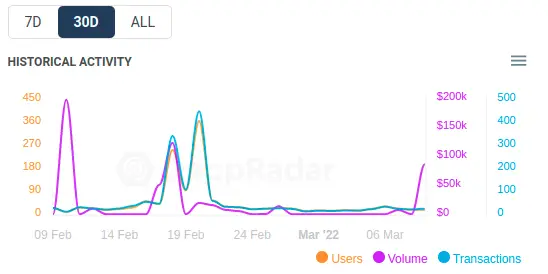

There is a LOT of volatility in the NFT market. The value and volume of a specific NFT collection can increase and decrease, and so can the overall usage of the marketplaces they are listed on.

Here’s an example of the 30-day market activity of a popular NFT, Meebits. In mid-February, there was over $100k in sales on some days, and the rest of the month was pretty quiet for sales volume.

NFT market volatility can be the cause of a lot of unforeseeable variables. For example, an influencer may promote a certain project, or new features could be announced for an existing project.

Crypto market volatility

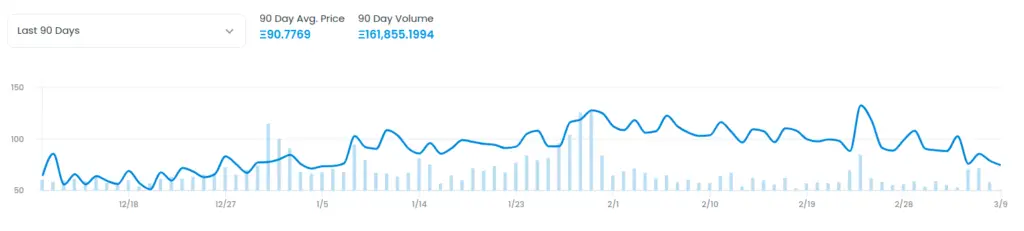

The cryptocurrency that NFTs are also volatile. The value of the currency can increase and decrease. Sales volume can spike, and drop off very quickly.

If you’re evaluating an NFT purchase you should be looking at the NFT collection volatility, marketplace volatility, and currency volatility.

Here’s the market activity on Solana. The value of Solana peaked at $258 USD in November 2021, and it’s currently worth $82 USD. So if you bought an NFT in November 2021 for 5 SOL and you wanted to sell it today, you would need to sell it for 16 SOL to make a profit.

On the other hand, if you had bought an NFT for 5 SOL in October 2021 when Solana was trading for $23, and you wanted to sell it for 5 SOL today, you would make a $400 profit.

The point here is that cryptocurrency is volatile, and NFTs add another layer of volatility to the equation. That’s not necessarily a bad thing either. Let’s say you bought an NFT for 5 SOL when it was trading for $23 and you wanted to sell today, but the floor price of your NFT is 15 SOL. If you combine that with the increased value of Solana, you can make a much larger profit.

So in essence, the gains can be bigger, and so can the losses.

NFT Hype

Hype is a driving force behind the value of an NFT. Collections that have built up a lot of interest can often charge a premium even right after minting. Some people even called NFTs the latest pyramid scheme.

When Logan Paul’s NFT collection launched, it had so much hype around it that it sold $1 million worth of NFTs in 30 minutes and $3.4 million on the first day.

The project was soon accused of ripping off Adobe stock photos and the project has been in hot water since then.

Market Speculation

Overall, NFTs and cryptocurrency are a game of speculation. That doesn’t necessarily make NFTs a poor investment choice, though. It just means you need to do your research and make informed decisions. If you’re comfortable navigating through market volatility you can buy and sell NFTs and make profits.

That doesn’t mean that profit is guaranteed though. You can definitely lose money on an NFT. If you’re considering buying NFTs you should talk to an expert that is well-versed in the world of NFTs and cryptocurrency before making any investments.

How to get started with NFTs

If you’re brand new to NFTs and you’re still learning what they are and how they work, you should continue learning about blockchain, cryptocurrency, and NFTs before making any immediate decisions.

Find projects you’re interested in, get in on them early, start small, and play it by ear. Consider talking to a financial expert that specializes in crypto and NFTs before you jump in.