With the recent boom of NFTs you’re probably wondering if NFTs are more likely to get a return on your investment than buying crypto coins. This guide will help you decide.

So should you invest in NFT or Crypto? If you’re new to crypto you should start with buying and selling coins. More experienced investors should consider NFTs. There is more risk involved with NFTs as the value of an NFT can increase and decrease, and so can the cryptocurrency it’s minted on.

That being said, there is no reason why you shouldn’t invest in both NFTS and cryptocurrency. Investing in NFTs can be a great addition to your crypto portfolio. Let’s look at some pros and cons of NFT vs Crypto.

NFT vs Cryptocurrency: Pros and Cons

NFT Pro: Own a unique digital asset

Owning a non-fungible token means you have a 100% unique digital asset where your ownership can be verified on a blockchain. No one can own the same NFT as you until you sell it. With cryptocurrency the only thing you own is the currency you currently hold in your crypto wallets.

The introduction of NFTs into the crypto economy futher expands the utility of cryptocurrency by allowing investors to buy, sell, and trade NFTs with crypto instead of just buying and selling various coins.

NFT Con: Value can be impacted by cryptocurrency value

NFTs have more market volatility than cryptocurrency because the value of an NFT can go up or down and so can the cryptocurrency it’s minted on. Your potential upside is higher but so is your potential downside.

Here’s a theoretical example. Let’s say you bought an NFT for 5 crypto coins and then the value of that coin drops by 50%. You would need to then sell your NFT for 10 or more coins to make a profit or wait for the value of the coin to go back up before being able to reinvest your earnings elsewhere.

Crypto Con: Buying and selling coins can be limiting

Many crypto investors simply buy and sell various coins and wait for markets to rise and fall in order to make a profit. While cryptocurrency can be used to purchase some things outside of the crypto market adoption is still a slow and gradual process.

If you’re limiting yourself to just buying and selling coins you might be missing out on potential NFT investments. If a new NFT collection that you got into early increases in value over a short period of time you would potentially stand to get a return on your investment faster than waiting for the cryptocurrency to increase in value.

NFT Pro: More upside potential

There is more risk and reward potential with NFTs. Here’s an example case of where NFTs provided a huge upside for early investors.

This CryptoPunk recently sold for $11.8 million dollars. These NFTs were originally given away for free years ago and were traded for around $100 before they recently skyrocketed in value.

A #NFT of ‘CryptoPunk’ digital artwork was sold for $11.8 million, according to a tweet by auction house @Sothebys. @e_howcroft reports https://t.co/7sK9va6STK pic.twitter.com/FHlr75A3ug

— Reuters (@Reuters) June 10, 2021

This is obviously a very unique scenario and most NFT investors won’t get gains like this. I’m just highlighting a great example of how more upside potential has been introduced to the market thanks to NFTs.

NFT Con: More downside potential

NFTs are a riskier investment than cryptocurrency which is already considered a high-risk investment.

When you buy an NFT the value could go down for numerous unforeseeable reasons. The value of the cryptocurrency you bought your NFT on could also go down for a number of reasons. In order to make a profitable investment on NFTs you need the value of the coin you used to stay stable or increase and you also need the value of the NFT to increase.

There are plenty of other risks involved with NFTs like getting hacked or even accidentally selling a bored ape for $3,000 instead of $300,000 due to user error and instantaneous trading. While the NFT market is highly speculative the technology behind it is solid and is bound to change the way people buy and sell things online. If you’re looking to invest in NFTs think about how the technology will impact the future and find projects where you can get involved. If you’re looking to make fast money flipping NFT art you could easily lose due to the high amount of risk involved.

Crypto Pro: More data

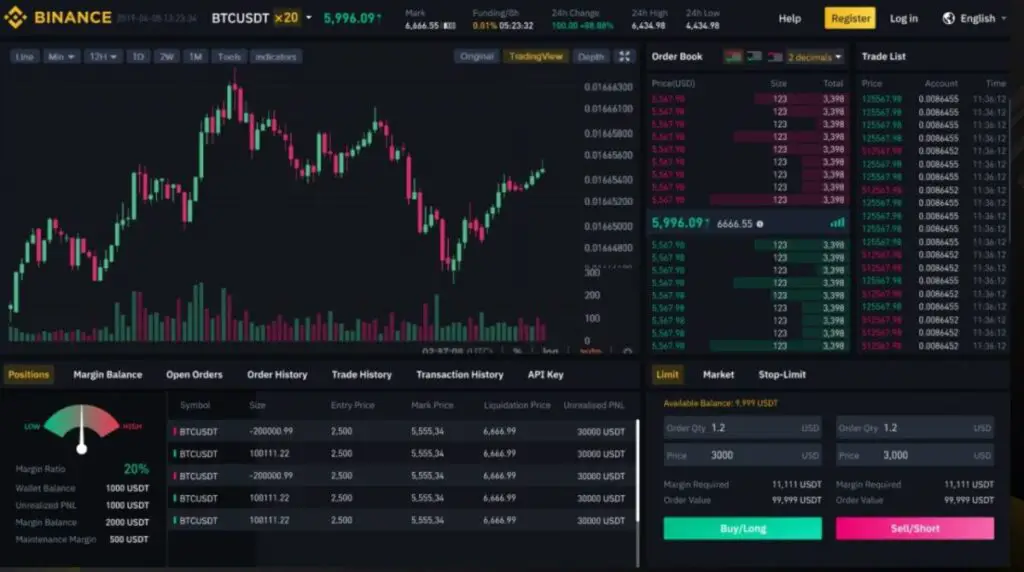

Cryptocurrency markets currently have a plethora of data compared to NFTs. While NFTs definitely have their fair share of data to help you make informed decisions it still doesn’t come close to how much data and tools are available to help cryptocurrency investors.

NFT data will improve over time as NFTs become more popular, but there will likely always be more data, analytics, tools, and software for crypto investing.

Crypto Con: Still risky

Regardless of crypto being less risky than NFTS it’s still a risky investment compared to non-crypto options. Cryptocurrency values go up and down rapidly and the value of a cryptocurrency often isn’t tied to an actual business, asset, or asset class. New coins are being introduced every day and the market is being flooded.

That being said it doesn’t mean you shouldn’t invest in crypto. Cryptocurrency is still a relatively new technology and is still in it’s “wild west” stage. There is a lot of potential to get involved in a great project as an early investor and make big returns if the project is a success.

If you do choose to invest in crypto be sure to do your research and make informed decisions. Consider talking to a financial advisor who is experienced in cryptocurrency before investing large sums of fiat money into crypto.

NFT Pro: More utility

Although NFTs are a relatively new technology the use cases for them are limitless. NFTs are essentially a smart contract that allows buyers and sellers to have proof of a transaction along with verified ownership and even built in automatic royalties without lawyers or signatures.

NFTs were first adopted by artists but they are quickly making their way into other industries like gaming, music, domains, sports, photography, and the metaverse. Buying NFTs can also act as an access pass to get into exclusive online groups. In the near future, you may even be able to buy your ticket to a sporting event as an NFT.

NFT Con: More fees

NFTS generally have more fees than cryptocurrency. There are transaction fees, minting fees, royalties, and taxes to take into consideration when buying, selling and creating NFTS.

While buying and selling cryptocurrency still has its fair share of fees, overall the fees are typically lower compared to NFTs. So if you’re just buying and selling crypto you will likely be able to pay fewer fees in the long run.

NFT vs Crypto: which one is right for you?

If you’re experienced with crypto and you have a higher risk threshold, NFTs may be the next big thing for your portfolio. But if you’re brand new to the world of cryptocurrency and still learning about how it works you should hold off on making any big NFT decisions as you’ll essentially just be gambling and could easily not see a return on your investment.

If you’re an investor who’s eager to invest in NFTs, try finding some projects you’re interested in and consider getting involved with the project as an actual investor instead of trying to make a quick profit flipping their NFTs when they drop on a marketplace. Do your research and find projects that you would like to invest in. Look at the team of people, their overall strategy, their project roadmap, and connect with them online. If you get involved at this level of detail you’re much more likely to make good decisions and be ahead of the curve.